|

Thank you for your support! Campaigns require the purchase of brochures, flyers, yard signs and newspaper advertising. Any contribution will be very much appreciated. If you have any questions please contact

donate@voteainslie.ca

Please note that only personal contributions are allowed

Please note that maximum contribution for a councillor is $750 Contributions to multiple candidates A person may give contributions to multiple candidates, however; there is a limit on how much the person can give to all candidates in each election.

For more details on rebates and all of contribution rules please click here |

Method of payment:

131 - 4662 Kingston Road Scarborough, Ontario M1E 4Y7 Donate online click the button bellow

Please note that only personal contributions are allowed to a maximum of $750

|

|

Contribution Rebate Program

• Toronto City Council has authorized a contribution rebate program for individuals who make monetary contributions to candidates running for mayor or councillor in the 2014 municipal election • Municipal campaign contributions are not eligible for federal income tax purposes • Corporations and trade unions are prohibited from making contributions to any candidate for the office of mayor or councillor • Contributor information is posted on the City's website for contributions totaling more than $100. o Searchable contributions on the website shows contributor's name, postal code, contribution amount and the name of the candidate they supported o The scanned copy of the candidate's financial statement lists the contributor's name, address and the contribution amount • A contributor cannot contribute $5,000 or more to two or more candidates on the same Council. Failure to do so may result in a fine up to $25,000 or imprisonment • Rebates up to a maximum of $1,000 are based on all contributions made to all candidates in the election o For example, if a contributor gave $500 each to three different candidates, the rebate is based on the total contribution of $1,500 o Refer to the reverse side of this guide for the rebate formula and sample rebate calculations Rebates are paid after: • The candidate has closed their campaign, filed an audited financial statement and complied with all requirements under the Municipal Elections Act, 1996 and the Contribution Rebate by-law • The compliance audit period has passed (90 days after the candidate's financial filing deadline) • Any proceeding in relation to a compliance audit has been completed |

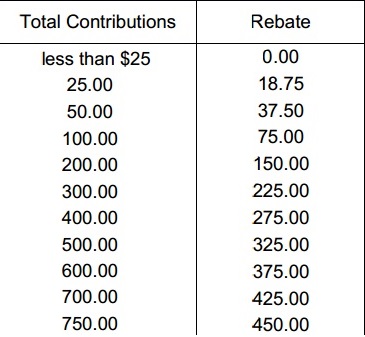

Rebate Formula

Total contributions of less than $25 are not eligible for a rebate Total contributions between $25 and $300 • Formula: total contribution amount x 75% • Sample: $200 x 75% = $150 rebate Total contributions over $300 but not more than $1,000 • Formula: total contribution amount minus $300 x 50% + $225 • Sample: $650 - $300 = $350 x 50% = $175 + 225 = $400 rebate Total contributions over $1,000 • Formula: total contribution amount minus $1,000 x 33 1/3% + $575 • Sample: $2,200 - $1,000 = $1,200 x 33 1/3% = $400 + $575 = $975 rebate $1,000 is the maximum rebate payable. Rebate payments are rounded up to the nearest dollar |